SF Public Pension Staff: Overpaid and Underperforming

Mediocre pension performance in an epic year

A rising tide lifts all boats.

President John F. Kennedy

As a participant in the San Francisco Employees Retirement System’s (SFERS) pension plan, many employees have enthusiastically shared outgoing Chief Investment Officer William Coaker’s memorandum boasting his 2021 performance. I would like to share some analysis and perspective.

Coaker’s Memorandum

Coaker returned to SFERS in 2014, after having been employed at the UC Berkeley pension for 6-years. SFERS Executive Director Jay Huish also came to SFERS immediately after being accused of public corruption at the same Berkeley pension. Huish’s and Coaker’s employment at Berkeley did not overlap, but the hiring of Huish demonstrates SFERS’ deficiency in background checks.

In his July 14, 2021 memorandum, Coaker stated:

For the Fiscal Year Ended June 30, 2021, Staff is pleased to report that SFERS Investments posted preliminary returns of 33.99% (rounded to 34.0%). Our returns in FY 2020-21 were historic. To put our returns this year into historical context, since 1985-86: SFERS preliminary fiscal year-end return of 33.99% is our highest return in at least 35 years, and likely further back than that. Hence SFERS funded status at year-end is estimated to be 112%.

Impressive—either SFERS really kicked ass, or maybe the SFERS pension was just a boat that lifted with the rising tide, but not as high as all the other boats.

Pealing back the onion: SFERS’ performance versus stock indexes:

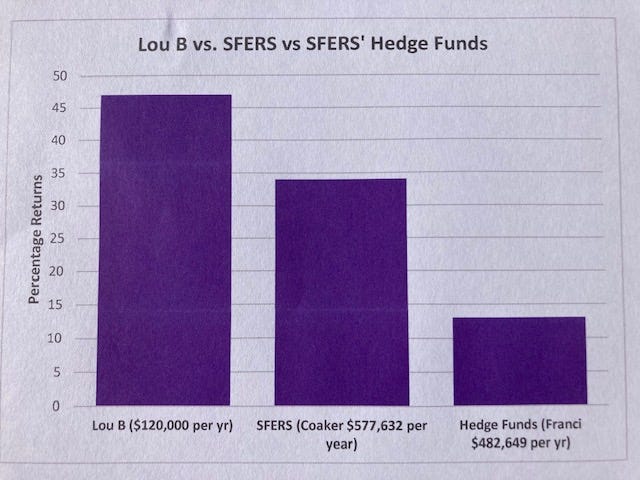

An investment manager’s success is measured on the degree to which he beats or trails the benchmark Standard & Poor’s Index. The S&P 500 is par, and any dummy can replicate its performance with very little effort. For the fiscal year ending June 30, 2021, Coaker’s 34% performance trailed the S&P 500 index’s 40% return by 6-percentage points. Yet in his memorandum, Coaker touted this subpar performance as a great victory.

Another way to measure Coaker’s performance is to compare how Coaker performed versus how an average city employee like me performed on my supplementary pension. SFERS offers city employees a tax-deferred annuity for their supplemental (already) tax-deferred 401k-style plan (technically an IRC 457 Plan.) I still maintain a small percentage of my investments on this SFERS platform so that I can monitor the variable annuity for my active city employee friends.

For the year ending June 30, 2021, I generated a 47% return on the SFERS platform versus Coaker’s 34% performance—that is I beat SFERS’ “highest return in at least 35 years” by 13 percentage points. Over the four-years preceding June 30, 2016, I also beat SFERS by an average of 3 percentage points per year.[i]

For just fiscal 2020, had Coaker piggybacked off my simple investment choices, the value of the SFERS pension would be $3 billion greater, and by my calculation, funded at 122%!

Coaker’s other multibillion dollar blunder: hedge funds

When William Coaker joined SFERS, he became the leading advocate for allocating SFERS’ pension assets to hedge funds, that is despite Warren Buffett submitting a letter directly to Coaker advising him to forget hedge funds and instead invest in the S&P 500 Index.

Hedge funds are weighed down by expensive fees, but coincidently are managed by some of the largest donors to elected politicians. As an example, if a hedge fund generates a 10% return for SFERS, say $10 million, the hedge fund would keep $4 million while shouldering no investment risk. Meanwhile, SFERS would only net $6 million while absorbing 100% of the risk for potential investment losses.

Coaker disallowed SFERS from disclosing which hedge funds were selected, how much was allocated to each hedge fund, and what the funds’ investment strategies were. This clandestine approach makes it impossible to match hedge fund managers’ political donations to prominently elected politicians, only to have the SFERS’ pension coincidentally later invest in that hedge fund manager’s product.

For the eleven months period ending May 31, 2021, SFERS reported hedge funds earned only 13.7%. Thus, for just 2020, the opportunity cost of William Coaker choosing hedge funds over Warren Buffett’s recommended S&P 500 Index fund was approximately $1 billion dollars. Add on the opportunity cost of hedge funds over Coaker’s entire tenure, and it raises the question why he was the highest paid City employee. Or why the SFERS managing director of hedge funds, was paid over $480,000 to essentially trail the S&P 500 index by whopping 27 percentage points in 2021.

The salary cost to produce SFERS’ mediocracy:

Over Coaker’s tenure, despite achieving subpar returns, six of the ten highest compensated SF public employees were employed by SFERS:

Per Transparent California 2019

William Coaker $577,632

Kurt Braitberg 483,072

David Franci 482,649

Tanya Kemp 451,507

Anna Langs 449,378

Andrew Collins 397,391

And for context:

Mayor Breed $342,974

SFPD Chief Scott 337,382

Harlan Kelly 318,643

SFFD Chief Nicholson 314,248

*The above figures are only salaries; it does not include the approximate $100,000 they receive in other benefits. *

Going forward: Hire talent, not career government enablers

This article is not about investment bragging rights, nor am I anti-public pension plans.

From my experience working for San Francisco, too frequently, talented technicians from the private sector are shunned in favor of hiring career public employees with an experience in enabling. That is what this column opposes.

There is a reason why four of the six highest paid SFERS investment professionals do not have Wall Street experience. In the real world, gross underperformance leads to a client exodus, which in turn leads to getting fired. Hopefully, Interim CIO Kurt Braitberg (formerly of Thomas Weisel Partners) can replace Coaker’s subpar performance and set SFERS back on the right course.

[i] I do not have access to investment performances for the years 2017 through 2019. I am posting my investment results because SFERS has access to my performances and the ability to challenge inaccuracies.

You left out the consideration of risk comparison. Your 100% equity portfolio assumes much greater risk than a pension plan should take. If the reverse would have happened (i.e. -40% S&P 500), your portfolio would have substantially underperformed. And you (and others) would be stressing how pensions shouldn't be 100% equities given their need to pay monthly cash benefit payments. The main comparison should be how the plan did against their own strategy benchmark and target return on a risk-adjusted basis. PLus, a 115% funded plan has no business taking on added risk that an individual around your age should be taking. Rethink your comparison please. Also, investment professionals always make more that City officials. And his pay and his team's pay is very low on a relative basis when compared to other investment professionals.

Lou,

I think this a fantastic article if you were comparing the results of a fund manager vs. whether an individual should use a wealth advisor or invest in an index fund. The Warren Buffett bet is such a powerful reference. I actually use it anecdotally often. However, it is hard to say that a pension system should be 100% vested in an index fund. That type of investment is not financially prudent when the retirement distributions (net cash flows) of thousands of former city employees rests on a single performance indicator (an index fund). I will add though that an individual should heed that recommendation while dollar cost averaging over the long run. Going back to another powerful Buffett quote, and I'm paraphrasing "we are all no nothing investors."

To be fair, comparing SFERS performance (while having a multi-asset capital allocation) to a 100% equity based index fund is not apples to apples. SFERS consists of many assets classes so the ~34% in spite of lessening the risk exposure to one asset class is pretty impressive. Furthermore, the pension hasn't been stressed tested in lean years. Protecting losses to the down side is NOT what investing in an index fund would yield for the pension fund.

I hear you on the hedge fund diabolical, but this was a product Coaker likely brought over from the educational endowment space. In the 1990's/2000's top-tier educational endowments started to invest in hedge funds and many of those funds did very well. Endownments were more nimble compared to the titantic moves of pension systems. Hedges funds were even great hedges into 2007/08 - hence the beneficial name. However, there was a lag in pensions getting into the space. Likely due to the conservative investment nature of pension funds. As they started to allocated capital to hedge funds, we ran into the great bull market. The same bull market which lead to Buffett's bet winning. The time lag to get in, along with the tailwinds of a bull market actually did not help the hedge fund performance. However, I'd be interested to see how the fund does in the lean years of a recession / correction.

full disclosure: I'm an employee of the SFFD, dollar cost average into an s&p 500 index fund in my 457 deferred comp plan, and max out my Roth IRA with the same investment strategy.