How Managers of SF’s Public Pension Left $5 Billion On the Table In 2024

Public employees forced to contribute more because SFERS investment managers ignored Warren Buffett’s advice

It happens in the corporate world. It happens within government agencies. It’s not what you know, it’s who you know. And it’s as old as the oldest profession. Cronyism, often cleansed by the term networking, involves hiring managers favoring friends for loyalty instead of for their potential value to the organization.

In fiscal 2024,[1] somehow, while “the market” was up 22.8%, the public employees that manage the San Francisco public employee pension (SFERS) only earned an 8% return. That is, “the market” nearly tripled SFERS’s return. In the private sector, or on Wall Street, investment managers would immediately be fired over such a shoddy performance.

If we multiply SFERS’s 15% underachievement by the pension’s 2024 beginning asset value of $33.6 billion, we learn that the pension missed out on an extra $5 billion in appreciation. The result of this is that public employees will have to contribute more of their salary to their pensions than they should have.

To give context to SFERS’ huge underperformance, Mayor Daniel Lurie is struggling to find ways to finance next year’s dinky $253 million city budget deficit, while SFERS cost city taxpayers and city employees 20 times that amount. Was this the result of the selection of the SFERS employees hired, or the hired employees’ selection of investments?

And yet, SFERS pays top salaries for the managers of the pension. Before benefits, in fiscal 2023, Alison Romano earned $678,381, Anna Langs $566,682, Kurt Braitberg $565,644, Tatyana Kemp $556,151, and David Francl $540,791. Measured only by base salary, they compose five of the top ten city salaries. The lowest of the five, was paid 48% more than Mayor London Breed in 2023.

Defining “the market?”

The “market” is most often referred to as the Standard & Poor’s 500 index (S&P 500 Index). The S&P 500 Index is similar to the more-famous Dow Jones Industrial Average. However, because the S&P 500 Index is composed of 500 companies, it is considered a broader index than the Dow Jones’ 30 stocks, and a better representative on the performance of the overall U.S. economy.

In 1976, John Bogle the founder of the Vanguard Group, created a low-cost passive mutual fund that replicated the returns of the S&P 500 Index. If investors, including pension plans, are acceptable to reaping the same performance as “the market,” they can invest in an autopilot investment vehicle[2] that matches the S&P 500 Index’s returns.

As Vanguard’s John Bogle famously said, “Don’t look for the needle. Buy that haystack.” If SFERS followed Bogle’s advice, skipped their allocation to opaque and complex investment vehicles, fired all their high-salaried employees, and invested in an S&P Index fund-- the pension would have been $5 billion fatter at the end of last year.

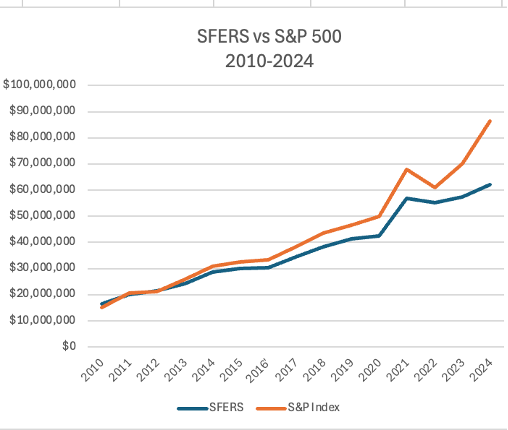

To front-run the apologists that will claim that SFERS’ 2024’s return was an anomaly, let’s compare the performances SFERS reported over the past 15 years to the S&P 500 Index returns for the same period.

SFERS’ track record versus the S&P 500 Index

Here is how the beginning fiscal year 2010 pension plan assets of $13.1 billion would have grown had SFERS instead substituted a simple index fund over the following 15 years:[3]

You can see that had San Francisco invested in an S&P 500 fund, the $13.1 billion in assets would have grown to $86.2 billion versus $62 billion by the SFERS’s employees.[4] That is, a dollar invested on July 1, 2009, in a passive S&P 500 index fund, would have grown to a 39% greater value than the 15 years’ worth of efforts by the city’s highest paid SFERS employees.

How can this be explained?

The UC Berkeley invasion of SFERS

If you reexamine the graph above, you can see that the staff at SFERS produced investment returns similar to the S&P 500 Index’s returns until around 2014. What happened in 2014? By coincidence, the UC Berkeley Invasion was in full force.

The first UC Berkeley invader was Jay Huish. At UC Berkeley, Huish hired a friend that had just been released from serving a two-year federal prison term for fraud. A subsequent audit of UC Berkeley’s pension exposed irregularities and Huish disappeared from Berkeley. The allegations from the Berkeley audit made Huish SFERS-ready. He was soon promoted to Executive Director of SFERS. A search of whether Huish obtained the standard financial accreditation for his position, a Charter Financial Analyst certificate, show he is license-less. Nevertheless, the city paid Huish a salary in 2020 of $323,000 and he now collects a $150,000 pension.

The second UC Berkeley invader was William Coaker, who had previously spent three years with SFERS, then became an investment manager at UC Berkeley. Coaker returned to SFERS as the Chief Investment Manager in 2014. Coaker once famously billed SF taxpayers for a limousine ride from Manhattan to the airport. Coaker claimed there were no taxis or Ubers available, so he was forced to flag down a limo. You can just hail a limo?

By coincidence, U.S. Senator Dianne Feinstein’s husband, Richard Blum was a board of regent at UC Berkeley. The former mayor of San Francisco was accused of accepting political donations, while her husband would then usher in those donors’ investment products into the UC Berkeley pension.

By coincidence (again), allegations against Feinstein and Blum at Berkeley, surfaced as 2014 accusations against Leslie Kautz of Angeles Investments. Kautz was an outside contractor/advisor to SFERS. In 2014, the SFERS Retirement Board received notice that Kautz’s husband, Jack Weiss, while running for City Attorney of Los Angeles in 2009, had accepted donations from investment companies.[5] Those donors’ investments were later validated by Kautz for the SFERS’ public pension. Is there a pattern here?

In this sketchy 2014 environment, newly hired Coaker started promoting hedge funds as an alternative to investing in public stocks. Infinitely smarter than Coaker, in 2008, Warren Buffett offered a $1 million wager to any investor that assembled a group of hedge funds that beat the S&P 500 Index over a 10-year period. Naturally, Buffett won the bet, but Coaker wasn’t listening. Nor was he listening when Warren Buffett wrote a direct note to a member on the SFERS Retirement Board of Directors advising SFERS to invest in index funds instead of hedge funds.[6]

As Buffett observed, hedge funds are only lucrative for the hedge fund managers. If an investment returns 10%, the hedge fund managers, without risking any capital, keep 40% of that return and only leave the remaining 60% for the pension. The fat fees that the alternative products (hedge funds, private equity, and venture capital) collect, positions them to be the largest donors to political candidates (i.e., Kautz and husband, Feinstein and husband). Alternatively, Amazon, Nvidia, and Apple don’t kickback money and hardly care if SFERS holds a position in their stock.

Public employees vehemently protested the proposed hedge fund allocation to their SFERS’ pension. But Coaker pushed through anyway. SFERS is not transparent on which hedge funds it invests in, so that conveniently conceals the trail of the hedge fund managers making political contributions and the politicians receiving them. Because of the negative connotation of hedge funds, Coaker got SFERS to retitle them “absolute investments” and immediately raised SFERS’s allocation of hedge funds to 12% of the pension.

Here is a snapshot of how the SFERS pension performed after Coaker’s 2014 tweaking:

In Coaker’s first year, the fiscal year ending in June 2014, the beginning balance of the SFERS pension was $18.5 billion. Applying SFERS’ actual annual performance, to those initial dollars, those dollars would have grown to $47.3 over the next 11 years. Had Coaker never been hired by SFERS, and SFERS simply invested in an S&P 500 Index fund, the total assets would have grown to $61.4 billion—a 30% greater return. Essentially, Coaker cost the city employees’ pension $14 billion over his tenure.

For missing out on $14 billion of easy gains, SFERS paid networker Coaker $596,000 per year and allowed him to ride in limousines.

Yale’s alternative investment model bombshell

Much of the push into alternative investments (hedge funds, private equity, and venture capital) was based on the earlier successes of David Swenson’s management of the Yale Endowment Fund. Swenson eschewed bonds and believed that liquidity was not important. I agree that liquidity should never be a priority, until you need the cash. To be clear, that’s sarcasm.

An investment in the companies of Amazon, Nvidia, or Apple are liquid, and can be converted to cash within 24 hours. On the other hand, to achieve liquidity with alternative investments requires an exit ramp. Either secondary buyers for the portfolio’s underlying holdings must be found to sell to, or the holding(s) have to go public on a stock market exchange.

Just in:[7] with the markets closed on the recent Good Friday, Yale quietly announced they are going to sell $6 billion of their alternative investments. A 180! That’s 14% of the endowment’s assets. This bombshell is contagious to the Coaker-designed SFERS pension in two important ways:

1) Yale’s exodus will drive down the value of all alternative investments as there will be more sellers than buyers. The alternative investments’ exit doors might not be able to accommodate everyone following in Yale’s wake.

2) No one knew what the true value of the alternative investments were inside of the SFERS pension. Now that sales prices will be discovered in transactions as pensions, like SFERS, will realize that the guesstimated values provided by the alternative product managers, who sometimes are also political contributors, were inflated.[8]

SFERS’s failure: poor employee selection, poor investment selection

William Coaker and his exorbitant salary added no value to the SFERS’s pension. The effects of his increased allocation into hedge funds still hampers the pension today. Why was he hired? What did he bring to the table? Or was he just accommodating the network?

In 2022, Huish and Coaker’s jobs were consolidated into a single position. Pretty conclusive there was redundancy, and they were overpaid. Mayor London Breed conducted a nationwide search to replace Huish and Coaker.

The nationwide search produced Alison Romano as the combined Chief Executive Officer and Chief Investment Officer. Amazingly, despite scouring the country, Romano had neither of the standard credentials for her position: a Chartered Financial Analyst license or a master’s degree. Even without those credentials Romano became the highest paid city employee at $678,381 in 2023. That 81% more than Mayor Breedearned.

I don’t like picking on Romano, she’s probably a nice person. But there are too many networking red flags to her hiring. The San Francisco Chronicle claims Romano is returning to San Francisco, so we have to assume she’s familiar with “the pattern” and SFERS considers investment performance returns inconsequential. After all, autopilot index funds only beat her work by $5 billion last year.

Romano’s hiring is almost like a city department hiring a music major to be its chief financial officer ($296,016 in 2023), while four employees that passed the CPA exam were assigned to manual labor tasks within the same organization. My bad, that happened at SFPD. I guess there is a pattern of networking in a lot of city departments.

Mayor Lurie, many people believe the SF public pension is lavish and unaffordable. They are wrong. The problem with the SFERS pension is the pattern of networking, which produces poor investment decisions on products confined from the insular network. I was one of the CPAs that sat on the bench while a person that apparently never took Accounting 101 ran my department’s finances. And you have access to verify that my SFERS’ 401k-type plan earned greater returns than the SFERS investment managers who were paid 4-times my salary. I’m not alone, networking is demoralizing for the work force you are going to ask to contribute more.

Like Warren Buffett, I’m willing to bet you that an index fund will outperform SFERS’ investment returns over the next ten years like it did over the previous ten. Substituting index funds for overpaid networked SFERS employees would put a huge dent in next year’s deficit and eradicate SFERS deficiencies to the market’s performance.

[1] Fiscal year ending June 30, 2024.

[2] Either mutual funds or exchange trade funds. Depending on how you count, there are at least 100 S&P 500 Index vehicles in existence today.

[3] I used the S&P’s 500 Index’s price on July 1st of each year. That results in overstatement of the S&P Index by duplicating that performance on July 1st of each year. Nevertheless, the duplication of one-day performance is immaterial compared to the huge underperformance of SFERS’ pension.

[4] We can’t compare the actual June 30, 2024 public pension balance of $35.3 billion to these amounts, because the pension’s asset size is a moving target, affected by hirings, firings, retirements, as well as investment returns.

[5] The details of this allegation exceeds the size of this article. Please contact me for this documentation.

[6] Warren Buffett’s handwritten response to a May 6, 2014 correspondence he received

[7] Grant’s Interest Rate Observer Vol 43. No. 8, April 25, 2025.

[8] Managers of alternative investments have a huge conflict of interest. If they inflate their guestimate on the value of their product, they reap a greater cut of the appreciation.

It is unclear whether this comparison is fair. The retirement funds of San Mateo counties over the past decade have experienced a similar performance compared to the S&P 500. It is essential to consider the preservation of capital. If the stock market had experienced a significant decline, with the S&P 500 falling by 2000 points, the retirement board would have been deemed incompetent for losing such a substantial amount. I attempted to include a graph comparing SamCera to the S&P 500, but I was unable to paste it.

I don't think the S&P 500 is a fair benchmark. A mix of fixed income, money market, and equities might be better for a retirement fund which must consider payouts and risks, and is more like an annuity. Viewed that way, the "underperformance" is far less.

Also, while Buffet recommends S&P 500 index funds for individual investors, that's not the way Berkshire Hathaway invests (they have a limited number of holdings and a lot of cash). Of course BERK.B had a better return than the S&P last year, but that portfolio has been a lifetime effort.

Nevertheless, I think your overall points are spot on.